H&R Block About

H&R Block is a tax preparation company that offers a wide range of tax preparation services to individuals, small businesses, and other organizations. The company was founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, and is headquartered in Kansas City, Missouri.

H&R Block’s tax preparation services include in-person tax preparation, online tax preparation software, and virtual tax preparation through its Block Advisors service. The company also offers tax planning and consulting services, as well as bookkeeping and accounting services for small businesses.

In addition to its tax preparation services, H&R Block also operates a retail banking subsidiary called H&R Block Bank, which offers a range of financial products and services including checking and savings accounts, credit cards, and home mortgage loans.

H&R Block is one of the largest tax preparation companies in the world, with over 10,000 retail tax offices in the United States, Canada, Australia, and India. The company serves millions of clients each year and has a reputation for providing reliable and accurate tax preparation services.

H&R Block’s Prices

H&R Block’s prices for tax preparation services can vary depending on the complexity of the tax return and the level of service required. However, here is a general breakdown of their prices:

- In-person tax preparation: Prices can start at around $69 for a basic federal tax return, but may increase based on the complexity of the tax return and the need for additional services such as state tax preparation or itemized deductions.

- Online tax preparation software: Prices can range from free for a basic federal tax return using the H&R Block Free Edition to around $104.99 for more complex returns using the H&R Block Premium & Business Edition.

- Virtual tax preparation: Prices can range from around $145 for a basic federal tax return using the Block Advisors Essential Plan to around $425 for more complex returns using the Block Advisors Premium Plan.

H&R Block’s Ease of Use

H&R Block offers various options for tax preparation, including in-person, online, and virtual tax preparation services, all of which are designed to be user-friendly and easy to use.

For in-person tax preparation, clients can make an appointment at one of H&R Block’s retail tax offices where they will work with a tax professional who will guide them through the process and answer any questions they may have.

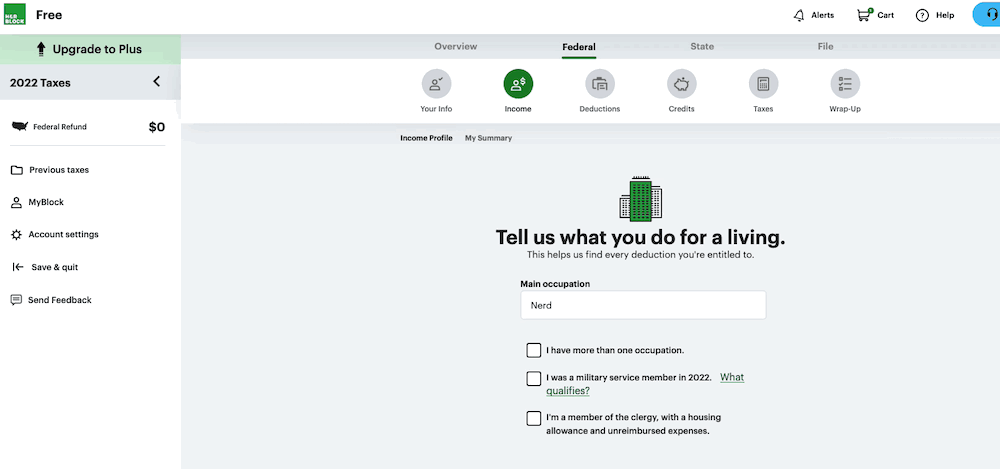

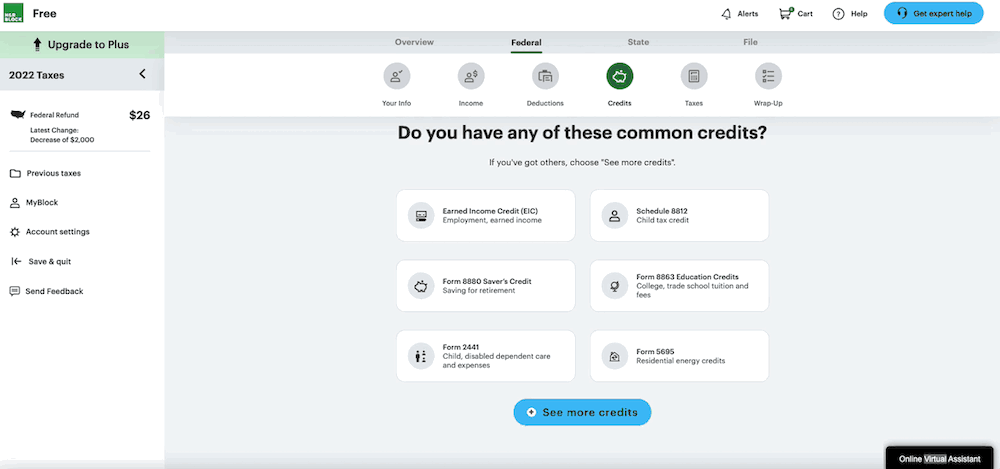

For online tax preparation, H&R Block offers user-friendly software that walks users through the process step-by-step and includes features like automatic import of W-2 and 1099 forms, deduction and credit maximizers, and free chat support.

For virtual tax preparation, clients can work with a Block Advisors tax advisor remotely using video conferencing technology. The tax advisor will guide them through the process, answer any questions they may have, and provide personalized tax advice based on their specific situation.

How it Works

The process of using H&R Block for tax preparation varies depending on the service option you choose. Here is a general overview of how each service works:

- In-person tax preparation: To use H&R Block’s in-person tax preparation service, you would first need to make an appointment at a retail tax office. When you arrive for your appointment, you will meet with a tax professional who will guide you through the process of preparing your tax return. You will need to bring all necessary tax documents, such as W-2s, 1099s, and receipts, to your appointment.

- Online tax preparation software: To use H&R Block’s online tax preparation software, you would need to create an account on their website and choose the appropriate software package based on your tax situation. You would then enter your personal information and tax documents into the software, which will guide you through the process of preparing your tax return. The software will automatically check for errors and help you maximize your deductions and credits.

- Virtual tax preparation: To use H&R Block’s virtual tax preparation service, you would first need to schedule an appointment with a Block Advisors tax advisor. At the scheduled time, you would log in to the virtual meeting using a computer or mobile device. The tax advisor will then guide you through the process of preparing your tax return, answer any questions you may have, and provide personalized tax advice based on your specific situation.

What It Looks Like

The appearance of H&R Block’s tax preparation process can vary depending on the service option you choose. Here are some examples of what each service option may look like:

- In-person tax preparation: When you arrive at an H&R Block retail tax office for an in-person appointment, you will typically be greeted by a tax professional who will guide you through the process. You will be seated at a desk or table where you can review and sign your tax documents. The tax professional will ask you questions about your income, deductions, and credits, and will use that information to prepare your tax return using H&R Block’s software.

- Online tax preparation software: H&R Block’s online tax preparation software has a user-friendly interface that guides you through the process of preparing your tax return. The software will ask you a series of questions about your income, deductions, and credits, and will prompt you to enter the relevant information. The software will automatically calculate your tax liability and refund, and will check for errors and missed deductions.

- Virtual tax preparation: H&R Block’s virtual tax preparation service uses video conferencing technology to connect you with a Block Advisors tax advisor. The tax advisor will appear on your computer or mobile device screen, and will guide you through the process of preparing your tax return. You will be able to see the tax advisor’s computer screen, which will show your tax return as it is being prepared.

Handy Features

H&R Block offers several handy features to make the tax preparation process easier and more efficient. Here are some examples of these features:

- Automatic import of tax documents: H&R Block’s online tax preparation software can automatically import W-2s and 1099s from many employers and financial institutions, which can save you time and reduce the risk of errors.

- Deduction and credit maximizers: H&R Block’s tax software includes features that help you maximize your deductions and credits, such as a deduction finder that identifies deductions you may be eligible for, and a credit optimizer that helps you choose between different tax credits.

- Mobile app: H&R Block offers a mobile app that allows you to check the status of your tax return, get answers to common tax questions, and connect with a tax professional.

- Refund advance: H&R Block offers a refund advance loan that allows you to get up to $3,500 of your refund in as little as one day after your tax return is accepted.

- Year-round tax advice: H&R Block offers year-round tax advice and support, so you can get answers to tax questions and guidance on tax planning throughout the year.

H&R Block’s Human Tax Help

H&R Block offers several options for human tax help, including in-person tax preparation, virtual tax preparation, and a tax pro review service. Here are some details on each option:

- In-person tax preparation: H&R Block has over 10,000 retail tax offices across the United States, where you can meet with a tax professional in person. These tax professionals have extensive training and experience in tax preparation, and can help you with even the most complex tax situations.

- Virtual tax preparation: H&R Block’s virtual tax preparation service allows you to meet with a Block Advisors tax advisor remotely, using video conferencing technology. The tax advisor will guide you through the process of preparing your tax return, answer your questions, and provide personalized tax advice based on your specific situation.

- Tax pro review: If you choose to prepare your own tax return using H&R Block’s online tax preparation software, you can opt for a tax pro review. This service allows you to have a tax professional review your tax return before you file, to ensure that it is accurate and complete.

All of H&R Block’s human tax help options are designed to provide you with personalized assistance and advice, tailored to your specific tax situation. Whether you prefer to meet with a tax professional in person, work with a tax advisor remotely, or get a review of your self-prepared tax return, H&R Block has a service option that can meet your needs.

H&R Block’s Support Options

H&R Block offers several support options to help you with your tax preparation needs. Here are some examples:

- Phone support: H&R Block’s customer service phone line is available 7 days a week, with extended hours during the tax season. You can call for help with technical issues, questions about tax forms, and other general tax-related questions.

- Chat support: H&R Block also offers a chat support option, which allows you to chat with a customer service representative in real time. This can be a convenient option if you need help quickly, or prefer to communicate through text rather than over the phone.

- Knowledge center: H&R Block’s website features a comprehensive knowledge center, which includes articles, videos, and frequently asked questions about tax preparation. This can be a helpful resource if you have general questions about tax forms, deductions, or other tax-related topics.

- Community forum: H&R Block’s website also features a community forum, where you can ask and answer questions about tax preparation. This can be a great resource if you have specific questions about your tax situation, or want to connect with other H&R Block customers.

The Bottom Line

H&R Block is a tax preparation company that offers a range of tax preparation and support services to individuals and businesses. The company’s tax preparation software is easy to use and offers a variety of features to help you maximize your deductions and credits, while its human tax help options provide personalized assistance and advice from experienced tax professionals.

H&R Block’s support options are also comprehensive, with phone support, chat support, a knowledge center, and a community forum all available to help you with your tax-related questions and concerns. While H&R Block’s pricing can be higher than some competitors, its reputation for quality and reliability make it a popular choice for many people who want help with their tax preparation needs.