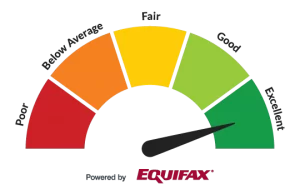

Building and maintaining check credit report is one among the best things you will do for your financial health throughout your lifetime. Having good credit score ensures access to the bottom attainable interest rates once you borrow & can improve your customary of living by creating it easier to get a mortgage, car loan, or rent an home.

what’s Borrowell?

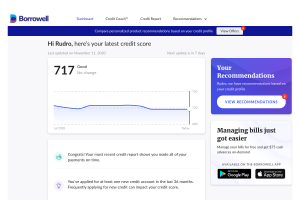

Borrowell exists with a single goal in mind: to assist individuals create nice choices regarding credit Score . to help achieve this goal, they provide customers a free monthly credit score and report via Equifax to assist Canadians continue top of their credit report . They conjointly act as a disposal platform by connecting borrowers to credit products, making it simple to use for credit cards , home equity credit & personal loans.

- summary of Borrowell features

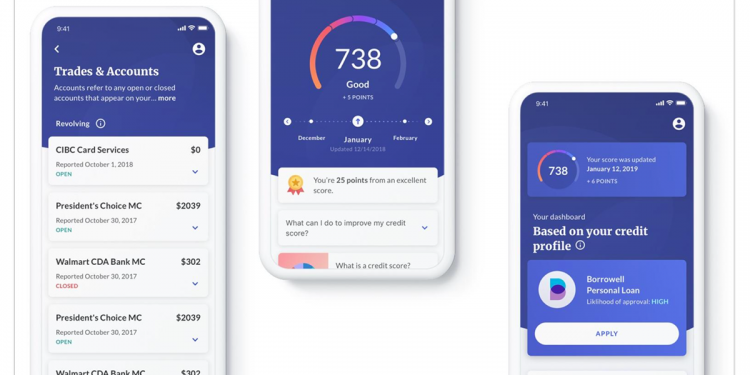

- Free weekly credit score & watching

- customized product recommendations from over 49+ partners

- Credit Education via AI-powered Credit Coach

- Tips to help you improve your credit report

- 256-bit, bank-level secret writing keeps your data safe

- obtaining Started with Borrowell

Borrowell is 100% free signing up only takes a few minutes. to urge started, you’ll got to provide your email and build a password. From there, Borrowell will gather some basic data to help them verify your identity.

you’ll not be needed to supply your SIN number, however they’ll raise questions that may help them connect you to the correct Equifax credit report. As before long as the signup method is complete, you will receive your 1st free credit score & report

Get Your Free Credit Score & Report with Borrowell

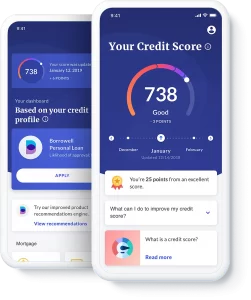

Borrowell will send you a free credit score & credit report each week & monthly , and in my opinion, it’s the most valuable service they offer. the best part is that they email it to you, saving you from having to remember to log in & check it on your own.

Will Borrowell’s Credit Inquiries Lower My Credit Score?

There are two major differing kinds of credit report that happen on your credit report : arduous credit inquiries & soft credit inquiries. arduous inquiries are utilized by lenders once you apply for credit. on every occasion a hard inquiry is made, it lowers your score slightly and is recorded on your credit report wherever lenders will see it.

Borrowell uses soft credit inquiries to examine your credit score. Soft inquiries are not shared on your report, & they are doing don’t lower your score. As such, you do not got to worry about your credit score being compact by a Borrowell inquiry.

Borrowell Bill tracking

Bill-tracking is free service offered by Borrowell. Connect your bank account to Borrowell, & they’ll allow you to understand approaching bill payment in due dates. With numerous other things on your mind, a reminder is usually nice.

Borrowell Product Recommendations

the other product offered by Borrowell is customized mastercard & loan recommendations. They modify over 49+ lenders to bring you offers supported your credit score. usually speaking, the higher your score, the a lot of enticing the interest rates you’ll be offered.

you will be wondering why an organization trying to assist you improve your credit would perpetually offer you new credit? Well, the solution is simple. It’s however Borrowell makes money & can give you a free credit report. once customers sign on for credit cards & loans through Borrowell, they earn alittle affiliate commission.

The good news is that you don’t got to settle for any of those offers. you’ll be able to ignore them & still get your credit report each week & each month . Of course, there is also a time when one of their counseled product makes sense, and if that’s the case, they create it incredibly easy to use and receive approval.